When you receive your paycheck, you may notice various deductions listed on your pay stub. Understanding these deductions can be a daunting task, especially when it comes to taxes. Taxes play a crucial role in funding public services and programs, and it’s important to comprehend how they affect your earnings. In this article, we will unravel the mysteries behind taxes on your paycheck stub, providing you with the information you need to know.

Federal Income Tax

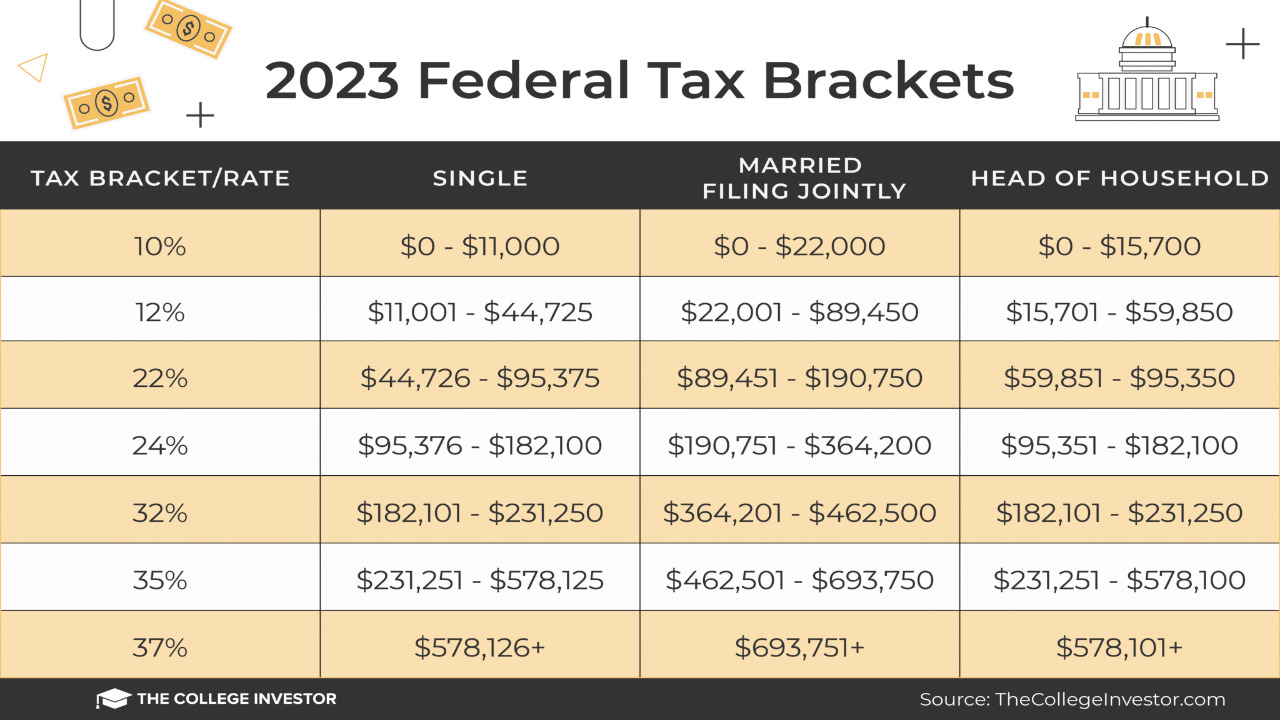

One of the most significant deductions on your paycheck stub is federal income tax. This tax is imposed by the federal government on individuals’ earnings and is based on a progressive tax system. The amount withheld depends on your income level and the allowances you claimed on your W-4 form when you started your job. It’s essential to review your withholding status periodically to ensure you are paying the appropriate amount of federal income tax. If you are interested in creating pay stubs, create pay stubs with PayStubCreator!

State Income Tax

In addition to federal income tax, many states also levy an income tax on residents. The amount deducted for state income tax varies depending on the state in which you live and its tax rates. Similar to federal taxes, your state income tax withholding can be influenced by factors like your income, marital status, and the number of dependents you have. Familiarize yourself with your state’s tax laws to understand the impact on your paycheck.

Social Security Tax

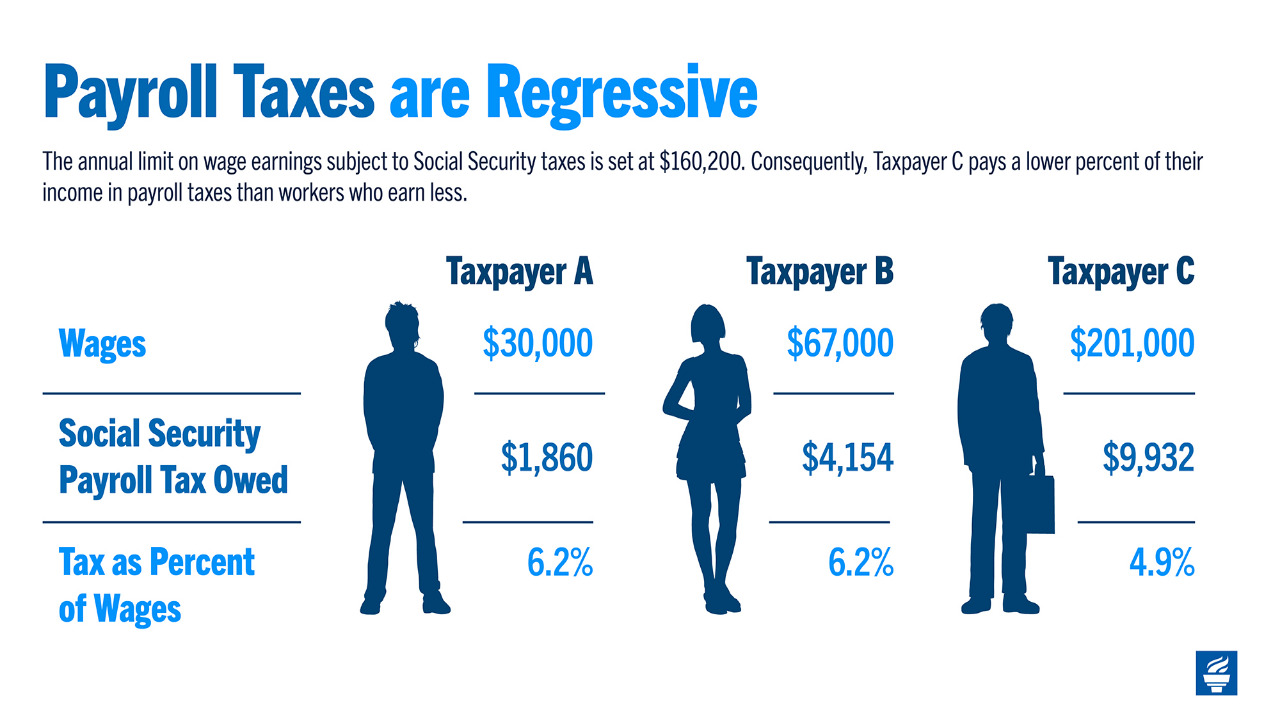

Social Security tax, also known as the Federal Insurance Contributions Act (FICA) tax, is a mandatory deduction that funds the Social Security program. This tax is split between employers and employees, with each party contributing an equal percentage of the employee’s wages. The purpose of Social Security tax is to provide retirement, disability, and survivor benefits to eligible individuals. It’s important to note that there is an income threshold above which additional Social Security tax is not withheld.

Medicare Tax

Another crucial deduction on your paycheck stub is the Medicare tax. Similar to Social Security tax, Medicare tax is also a part of the FICA tax. It helps fund the Medicare program, which provides healthcare benefits to individuals aged 65 and older. The Medicare tax is split between employers and employees, and there is no income threshold for this tax. The rate for Medicare tax is fixed and does not vary based on income.

Other Deductions

In addition to the taxes mentioned above, your paycheck stub may include other deductions, such as state disability insurance, local taxes, and voluntary contributions to retirement plans or healthcare benefits. These deductions are specific to certain regions or employers and can vary greatly. Make sure to review your paycheck stub carefully to understand the purpose and impact of these additional deductions.

Tax Forms and Reporting

Throughout the year, you will receive various tax forms that summarize your earnings and deductions. The most common form is the W-2, which your employer provides at the end of each year. This form outlines your annual income, taxes withheld, and other relevant information needed to file your tax return. It’s crucial to retain these forms and use them when filing your taxes to ensure accurate reporting.

In conclusion, understanding the deductions on your paycheck stub is essential for managing your finances and planning your tax obligations. Federal and state income taxes, Social Security tax, Medicare tax, and other deductions can significantly impact your take-home pay. Stay informed about the tax laws in your jurisdiction, review your pay stub regularly, and consult a tax professional if you need assistance. Being knowledgeable about your taxes will help you make informed decisions and ensure compliance with your tax obligations.